To our Customers, Directors,

Corporators, and Employees

It takes more than financial resources to help people on their journeys, support businesses, and grow our communities. It takes an exceptional commitment to those groups, as well as the strength, stability, and independence to make a real and lasting difference.

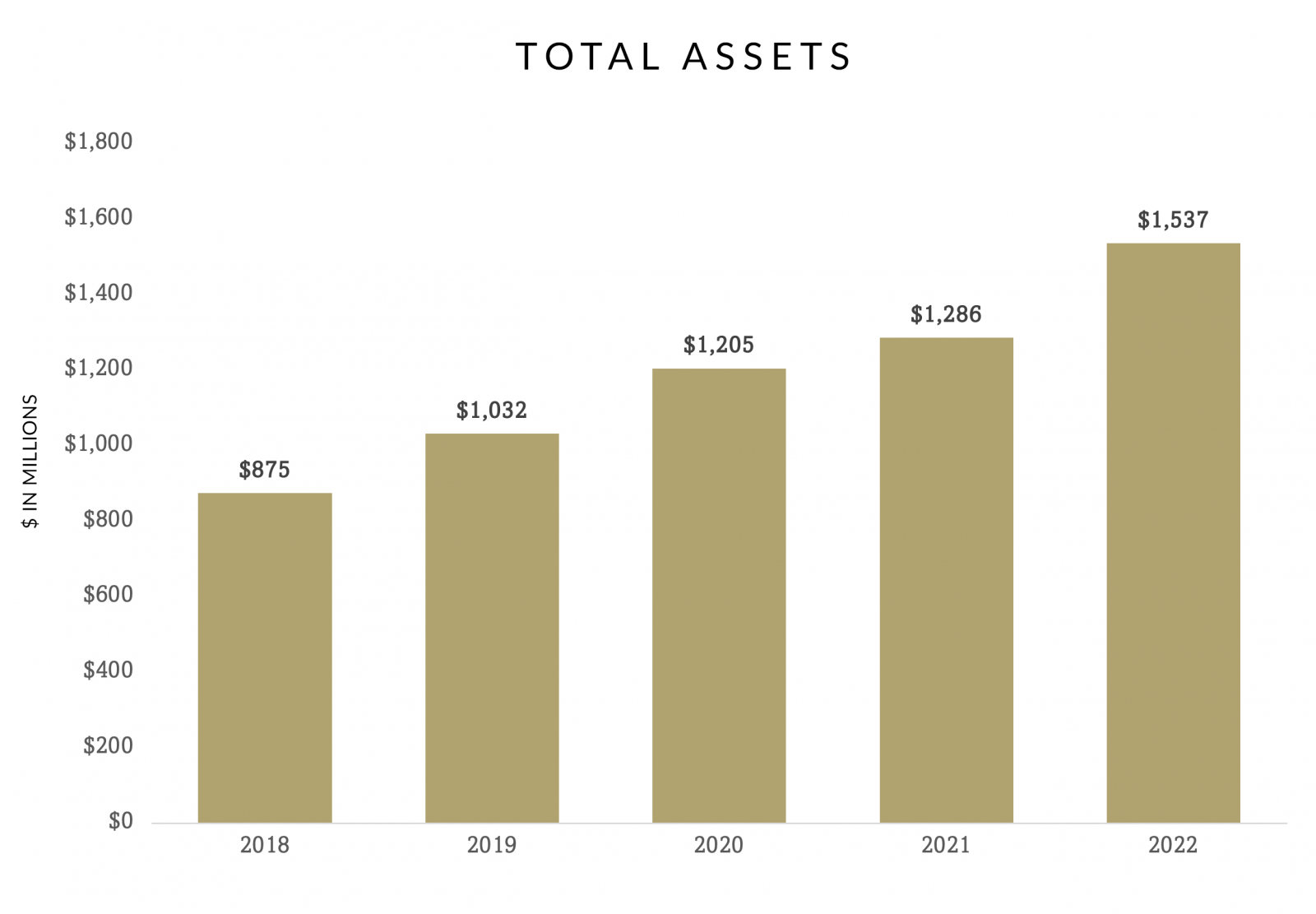

Growth Goals Surpassed

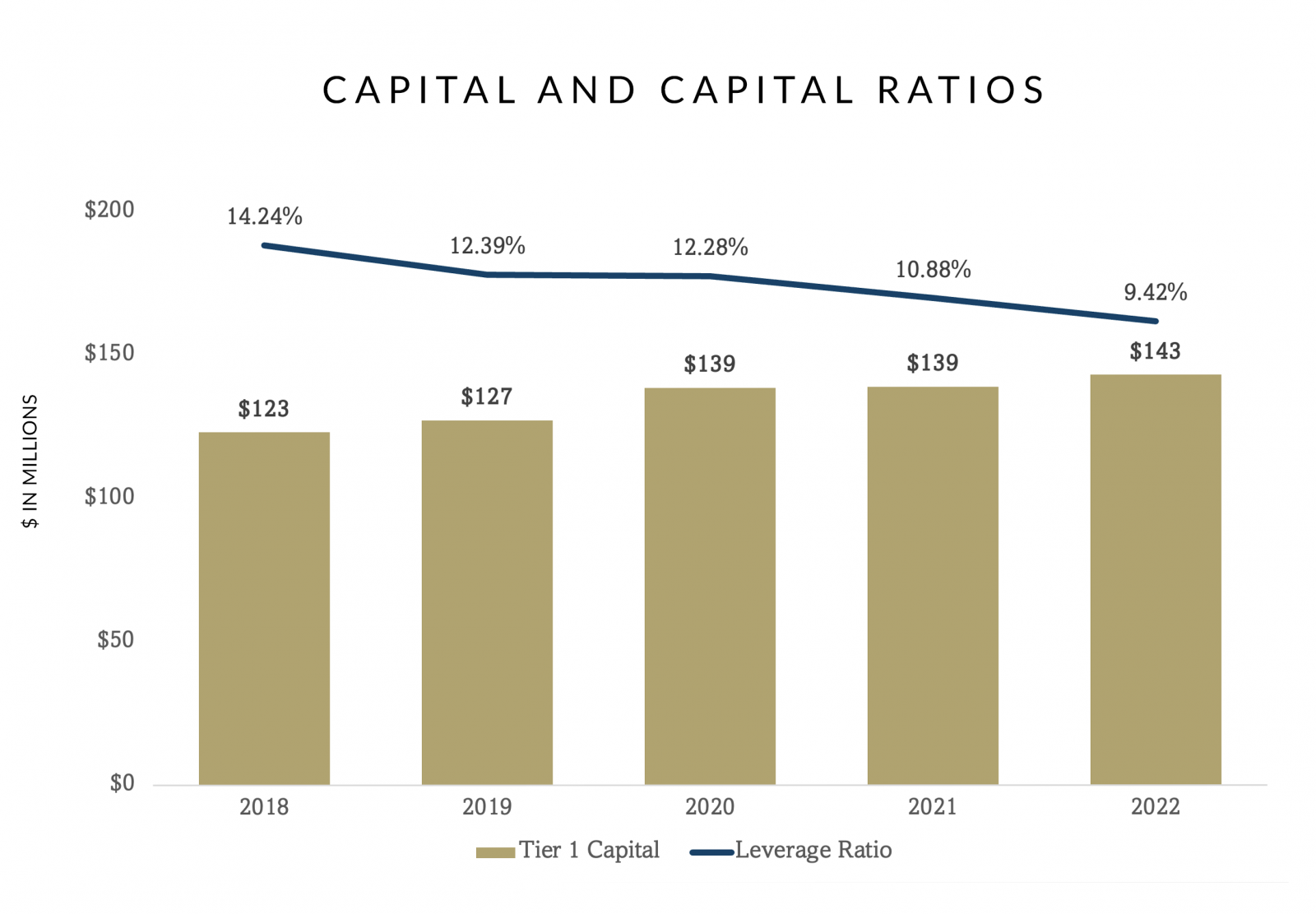

Today, the parent company of Newburyport Bank is celebrating growth—the growth of our organization and the success of the people, businesses, and communities we’ve served. Our long-term vision coupled with day-to-day effort has resulted in phenomenal growth numbers. We surpassed our goal of $1.5 billion in assets more than one year ahead of our five-year schedule. In addition, we’ve maintained capital ratios above 9 percent while the company doubled in size.

The results of our continuous commitment.

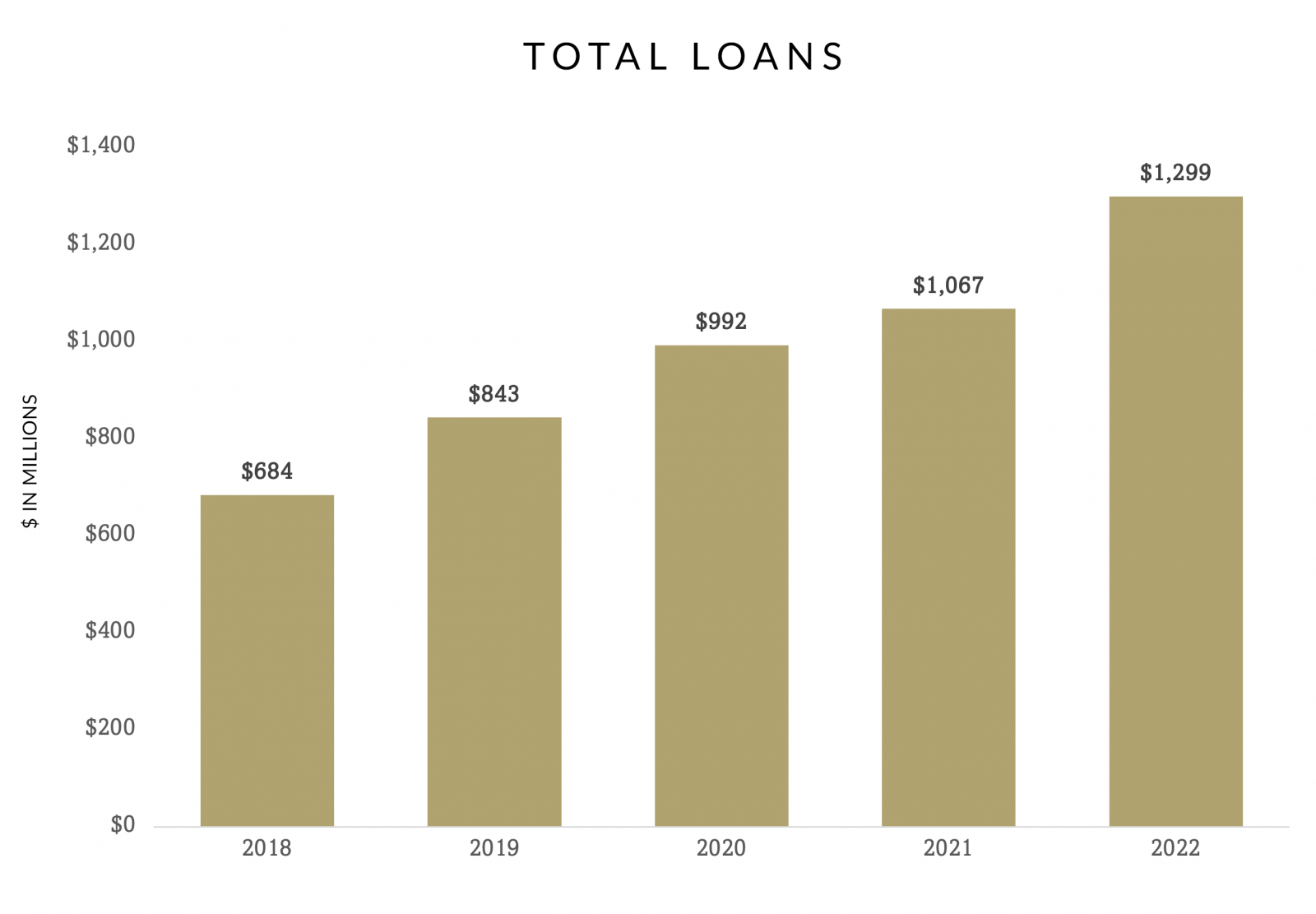

Lending

Our Lending Teams saw a record year in 2022 and reached over $1.2 Billion in loans.

Spirit of Giving

In 2022, 26 organizations were served by Spirit of Giving, and over $20,000 was donated to these causes.

Capital Ratios

We’ve maintained capital ratios above 9 percent while the company doubled in size.

Cash Management

Five years ago, 34 customers were using the online business banking platform; today more than 1,000 use it.

A Relevant Financial Partner

Impressive as these numbers are, we are most honored by the fact that more people and businesses are taking advantage of the products and services we offer, increasingly putting their trust in our organization, instinctively turning to us when there’s a need, and viewing us as a relevant financial partner.

A Valuable Resource

As a bank that consistently anticipates and meets the expectations of our customers, we have become a valuable resource in our communities. In 2022, Newburyport Bank was named Business of the Year by each of the chambers of commerce in Amesbury, Newburyport, and Salisbury, a distinction that recognizes our ability to serve our customers’ changing needs, to be more accessible, and to meet people where they are on their journeys.

A Community Servant

A true servant of the community, Newburyport Bank donated more than $1,000,000 to charitable causes, including $150,000 to Exeter Hospital for the benefit of their Center for Cancer Care. Through our Spirit of Giving, employees donated their time and money to causes that are dear to them. From building beds to hosting fraud awareness seminars, this bank was out in the community serving, leading, and making a significant and positive impact.

Planning for the Future

True leaders earn trust, demonstrate strong purpose, guide with care and integrity, and are exceptional at translating vision into reality. To ensure the continued strength of our organization, we are always mindful of training, mentoring, and succession planning. We are embracing the journey ahead with an emphasis on leadership development and employee advancement.

The Commitment Continues

Looking ahead, were focused on continuing our commitment, exploring ways to further improve our products and services, staying innovative, researching new ideas, and always striving for excellence. What won't we do? Rest on our achievements. There is still so much more we can do to better the lives of our customers, grow our local businesses, and strengthen our communities.

Milestones

Business Services

When businesses need support, they can find everything they need at Newburyport Bank. Our Commercial Lending team saw a record year in 2022 and reached more than $700 million in loans. The business community is increasingly learning that a better journey for their business starts here—with the local bank that provides market expertise and exceptional personalized service. To address the many and various needs of our customers, we offer several services, including Cash Management, Business Banking, and Corporate Banking.

For Your Convenience: Expanded Hours

While other banks are cutting back hours, were enhancing them. The launch of our live, interactive teller machines (ITMs) is part of our bigger movement to build a bank that works around the needs of our customers, instead of expecting our customers to build their day around us. The ITMs add more convenience and efficiency to banking without losing sight of the personal connection. Our customers can communicate in real-time with a Live Banker, get help with more complex banking needs, receive change of any denomination, and access bankers before, during, and after business hours. In addition, we offer Live Chat through our mobile app and online banking on any device.

Cash Management

We've had great success in scaling growth with our Treasury Management services, which are designed to work in partnership with our Commercial, Retail, and Government and Nonprofit departments. Five years ago, 34 customers were using the online business banking platform; today more than 1,000 use it. These customers use money more efficiently, protect against fraud, and have more control over their finances with products such as:

- Zero Balance Accounts

- Merchant Services

- Positive Pay

- Remote Deposit Capture

- Direct Payroll Deposit

- Wire Transfers

- And more

Its been an exciting, meaningful, and humbling journey to work with a crew of amazing guides who are always seeking to make lives better for everyone. As we look back on our successful year as a bank—and reflect on the culmination of many prosperous years—we are confident that our neighbors, friends, families, local businesses, and communities will have the products, resources, and support needed to ensure continued success and bright futures.

Lloyd L. Hamm, Jr.

President and CEO

LETTER FROM OUR PRESIDENT

LETTER FROM OUR PRESIDENT.png) OUR LEADERSHIP

OUR LEADERSHIP.png) FOUNDATIONAL INVESTMENTS

FOUNDATIONAL INVESTMENTS.png) SUPPORTING COMMUNITY

SUPPORTING COMMUNITY BUSINESS SERVICES

BUSINESS SERVICES CUSTOMER TESTIMONIALS

CUSTOMER TESTIMONIALS.png) STRATEGIC PLANNING

STRATEGIC PLANNING PRESIDENTS AWARD

PRESIDENTS AWARD